Yearly depreciation formula

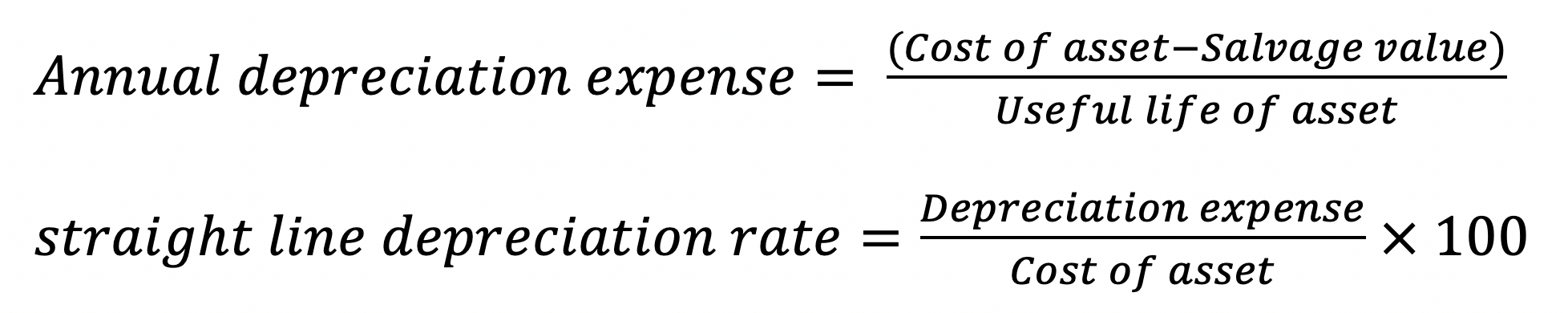

The syntax is SYD cost salvage life per with per defined as. Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

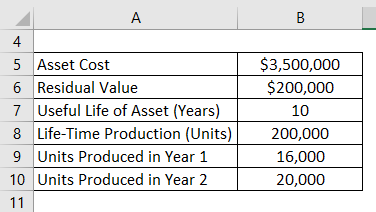

1useful life of the asset Depreciation Value per year Cost of Asset Salvage value of Asset Depreciation.

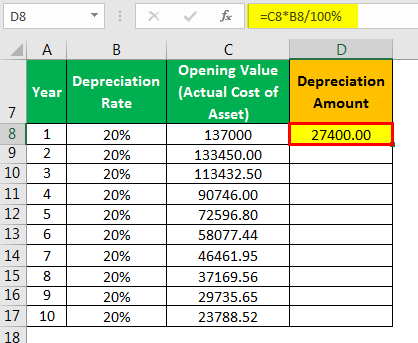

. Depreciation Rate per year. This rate is calculated as per the following formula. Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful.

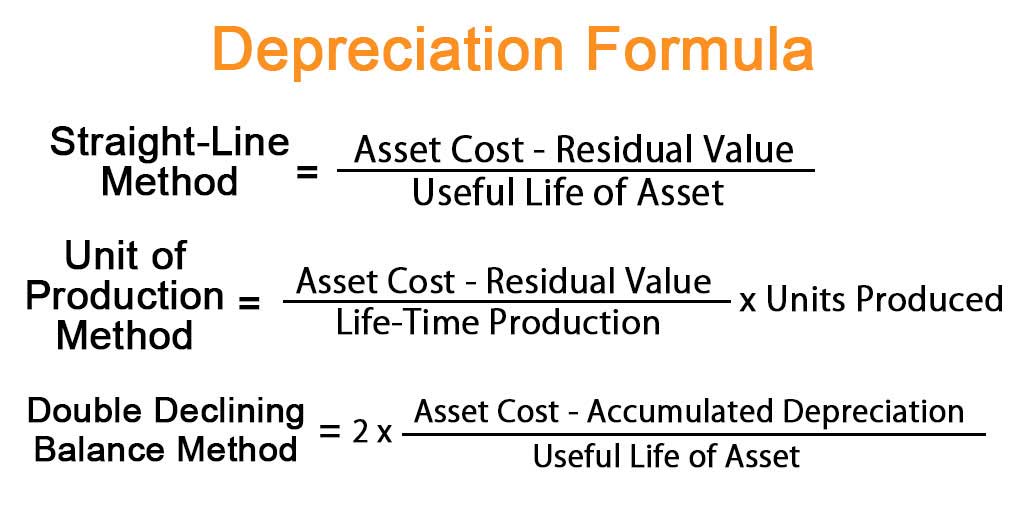

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Divide the assets cost basis by the total expected units of production to find the per unit depreciation expense. He depreciates the patent under the straight line method using a 17-year useful life and no salvage value.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. For annual depreciation multiply the number of units produced.

In April Frank bought a patent for 5100 that is not a section 197 intangible. For example the first-year. Monthly depreciation Annual.

Straight Line Depreciation Formula. How to calculate the depreciation expense for year one. There are various methods to calculate depreciation one of the most commonly used methods is the.

Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value To calculate this value on a monthly basis divide the result by 12. Non-ACRS Rules Introduces Basic Concepts of Depreciation. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a.

Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would. Same Property Rule. The calculator will display how the asset will depreciate over time the depreciable asset value the yearly depreciation rate and the annual depreciation.

The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. Annual depreciation Total depreciation Useful lifespan Finally dividing this by 12 will tell you the monthly depreciation for the asset.

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

A Complete Guide To Residual Value

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Aasaan Io Blog

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Annual Depreciation Of A New Car Find The Future Value Youtube